Global Casino Revenue & Market Analysis 2026

Article by

Updated by Jacob Evans Jan 29, 2026

Global casino revenue surged past $305.8 billion in 2024, proving the industry's resilience and dynamism. Whether it's Vegas glitz, Macau jackpots, or bettors hooked into mobile apps on every continent, demand isn't slowing - it's intensifying year on year.

By 2033, experts project total revenue to rocket over $542 billion, as casino floors morph into global digital playgrounds drenched in tech. For anyone looking to separate hype from hard numbers, stick around for a casino market analysis worth betting on.

.jpg)

Casino Revenue Breakdown 2026: All Channels Compared

Revenue is the heartbeat of this industry. But it's not just about how much is coming in; it's about where it's coming from. Traditional casinos still bring home the bacon, but digital segments are stealing the spotlight. This section explores the structure of global casino revenue, from slot machines to smartphone apps.

Land-Based vs online casino revenue growth

The gambling landscape is diversifying faster than ever. From roulette tables to remote roulette apps, the industry is adapting to meet the modern player and making serious money doing it. Here's how the pieces of the global revenue puzzle are fitting together.

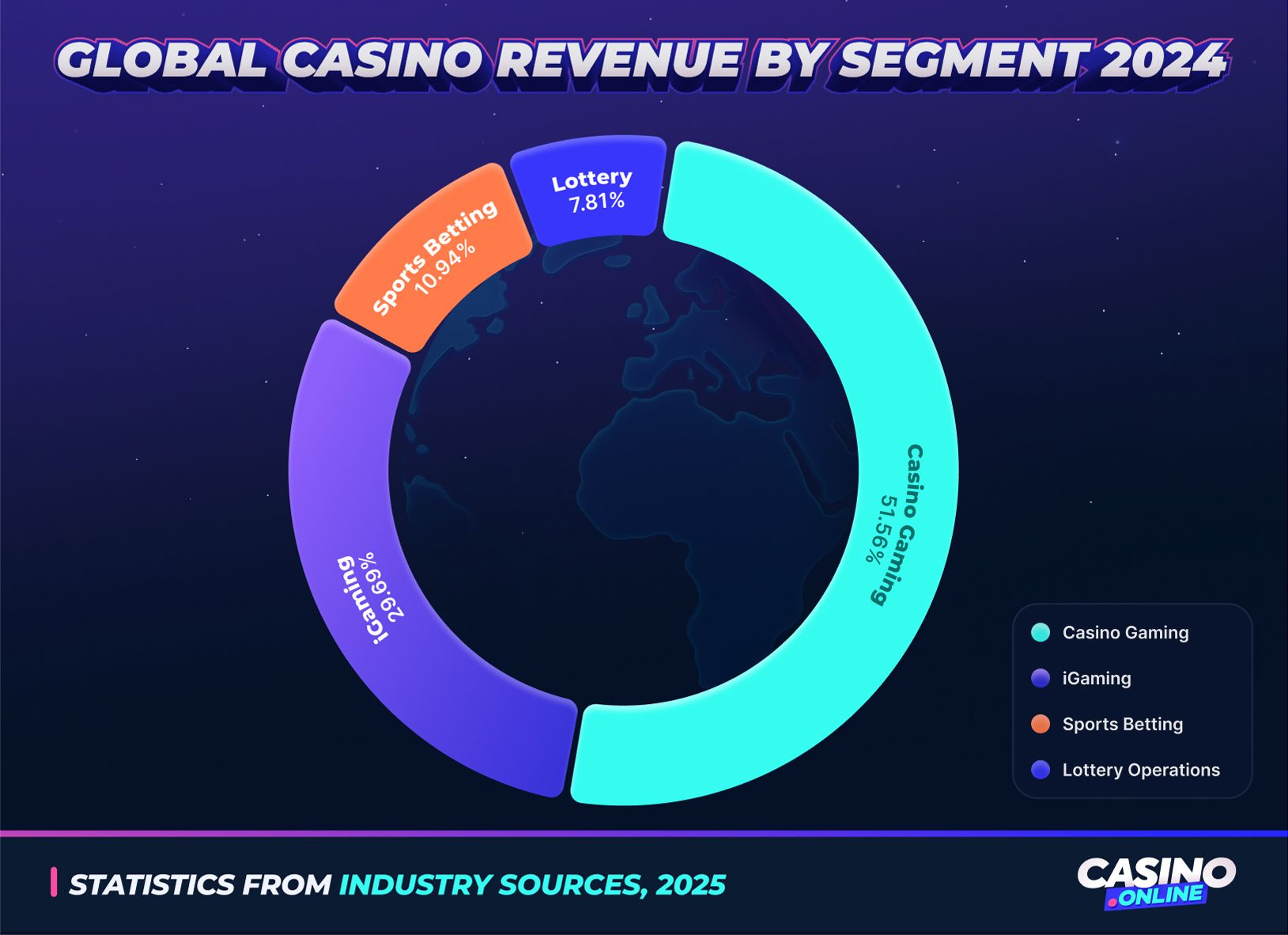

Here's how the chips fell in 2024:

- Traditional Casino Gaming: $165 billion, still the backbone, accounting for 54% of total revenues.

- Online Gambling/iGaming: $78.66 billion, a rising star at 26%.

- Sports Betting: $35 billion, an 11% stake and growing fast.

- Lotteries: $27 billion, stable at 9%.

We're witnessing the slow and steady tipping of the scales. Sure, land-based casinos still lead the pack, but the writing's on the digital wall. iGaming is expected to nearly double to $153.57 billion by 2030, an 11.9% CAGR. The growth is being driven not just by convenience but also by mobile tech, crypto accessibility, and players demanding immersive, real-time gameplay.

Opinion of Andrew Collins

“Pro Insight: I've seen firsthand how major operators now treat digital not as a side hustle, but as the main game. Loyalty programs, VIP perks, even hotel bookings are being tied to mobile gaming performance. It's omnichannel or bust.”

Regional Casino Revenue Analysis: North America, Europe & APAC

Every region plays its cards differently. What's booming in Nevada might be struggling in Norway, and Asia-Pacific is a whole different ballgame altogether. This section breaks down who's winning, who's growing, and where the next big jackpots might come from.

North America casino revenue 2025: Market leaders & stats

North America, particularly the U.S., remains the global benchmark, but not just for glitzy casinos. It's leading in tax generation, job creation, and the fast-growing world of legalised sports betting. Let's look at what's driving the growth stateside.

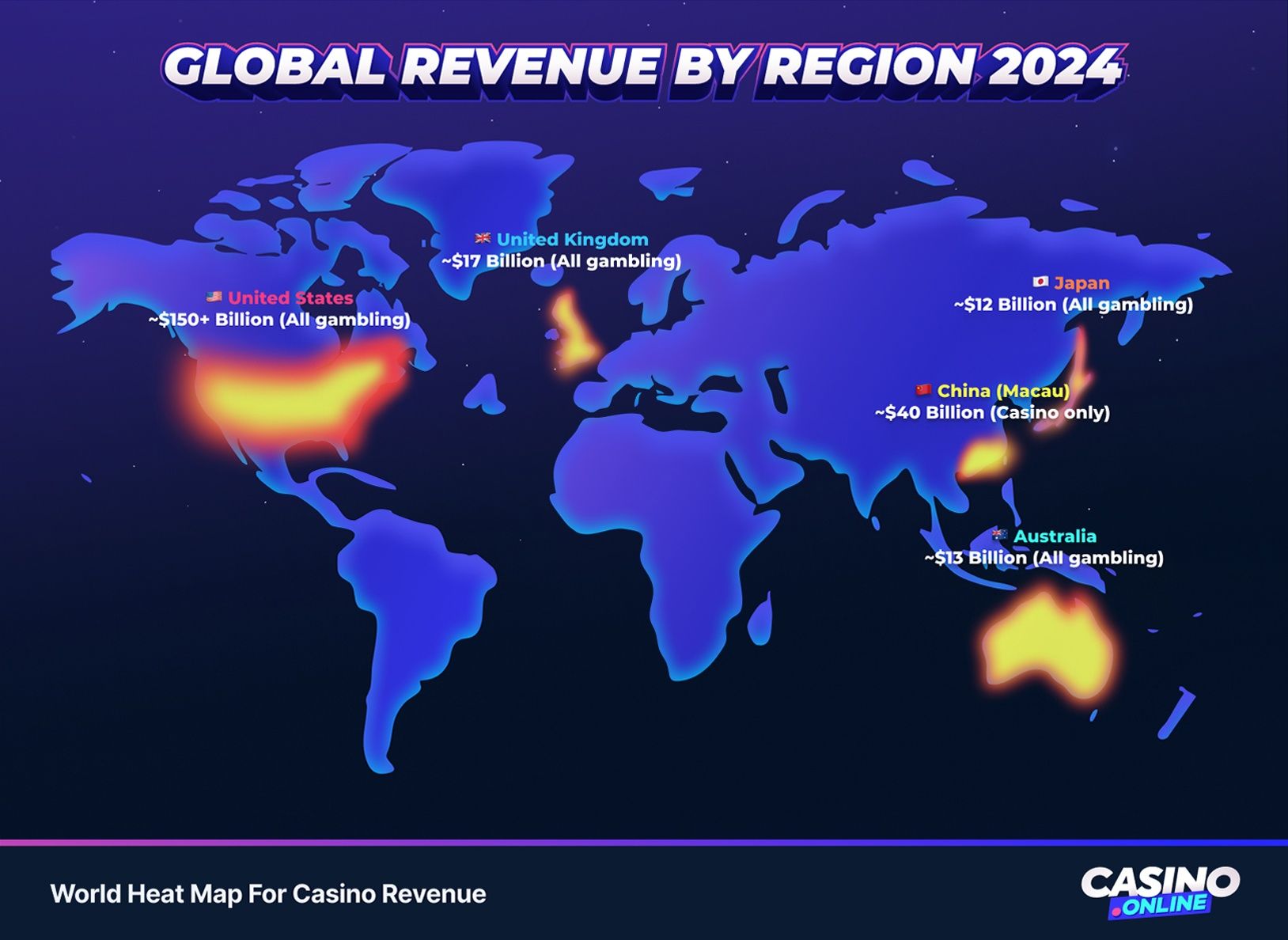

- $72.04 billion in 2024 revenue, a 7.5% year-over-year increase.

- 28 out of 38 commercial gaming jurisdictions hit all-time highs.

- Nevada alone brought in over $15 billion in GGR.

But don't get too dazzled by the roulette wheels. It's the digital side pulling in the wildest gains. Sports betting exploded in 2024 - up 24.8% - thanks to North Carolina and Vermont jumping into the game.

And those taxes? In 2024, commercial gaming pumped $15.91 billion into U.S. state and local governments. That's not counting income or corporate taxes; that's just the direct gaming cut.

Opinion of Andrew Collins

“Analyst Take: Digital platforms are beginning to outshine the gaming floors in revenue velocity. If regulators continue approving new markets, expect this trend to accelerate.”

European casino market trends: Online & land-based 2025

Europe has long been a leader in regulated gambling markets, but now it's setting the pace in digital adoption. That said, fragmented regulation and steep tax structures present real challenges. Here's how the region's balancing old-school glamour with new-school innovation.

Europe might not have Vegas, but it leads globally in online revenue share. In 2024:

- €123.4 billion ($133.4B) in gross gambling revenue.

- €47.9 billion from online, a robust 11.7% YOY growth.

- Slots and online casinos: €23.2 billion of that pot.

Still, don't count out the land-based side. Despite slower growth, traditional casinos brought in €75.5 billion, maintaining a 61% revenue share.

Reality check

While digital gaming is exploding, regulation varies dramatically across borders. Germany's 90% GGR tax is a mountain; Malta's 5% feels like a molehill. Operators must juggle multiple tax codes, compliance rules, and data privacy standards.

Opinion of Andrew Collins

“On-the-ground Insight: I've consulted for brands expanding in Europe, and the biggest hurdle isn't demand - it's red tape. Smart brands hire local legal teams and move fast but careful.”

Asia-Pacific casino market analysis 2025: Growth engines unleashed

Asia-Pacific's story is one of potential and volatility. You've got mega-operators in Macau, a massive mobile-first population, and growing cultural acceptance of gaming. But it's not all smooth sailing. This section explains why APAC could lead the industry or lag behind.

With $104 billion in 2024 gambling revenue, APAC isn't just rising - it's roaring.

Macau's bounce-back

After a rocky couple of years, Macau's casinos have stormed back to life, pulling in MOP 226.78 billion (around $28.3B) in 2024, nearly 24% more than last year. That's not a recovery; that's a full-blown rally.

Digital surge:

Across the Asia-Pacific region, online gambling brought in $19.06B, and it's showing no signs of tapping the brakes. By 2030, forecasts say that the number will more than double.

Why is it taking off

Here's what makes APAC tick: Gambling isn't just a pastime; it's part of the leisure-tourism circuit. In places like the Philippines or Vietnam, a trip to the casino comes packaged with five-star resorts, night markets, and digital-first payment options. It's entertainment, commerce, and culture rolled into one.

Top Casino Operators 2025: Industry Analysis & Strategy

Every industry needs its heavyweights, and in gambling, a few familiar names continue to dominate the table. But they're evolving, too, moving beyond casinos and into mobile, sports, and international markets. Here we spotlight the top players and how they're staying ahead of the pack.

Top Players in 2024

Knowing who the leaders are isn't just trivia, it gives you a window into what strategies are working. Are they leaning into digital? Expanding overseas? Innovating with technology? Let's take a closer look at the casino titans and how they earned their seats.

- MGM Resorts: $17.24B revenue. Notably, MGM China surged 27.6%, a major recovery story.

- Flutter's Masterstroke: What really caught my eye was how Flutter's not playing one-size-fits-all. Whether it's FanDuel dominating U.S. sportsbooks or PokerStars thriving in Europe, they tailor the experience to local tastes. That's a scalable model, and it's one every competitor is eyeing closely.

- Caesars: $11.2B revenue, with 60% digital growth. Their iGaming unit, Caesars Digital, posted a surprise $117M EBITDA.

- Las Vegas Sands: is sticking to its playbook: high-end resorts in destinations where luxury is the main attraction. With a $27.42B market cap, they're doubling down on the "stay longer, spend more" crowd, think business elites and casino whales lounging in five-star suites.

For players looking to experience online versions of these industry-leading brands, our comprehensive online casino reviews provide detailed analysis of game selection, bonus offers, and payout reliability.

Opinion of Andrew Collins

“What Stood Out to Me: Flutter's cross-market agility is impressive. They tailor offerings by region, blending global scale with local insight, a model others are rushing to replicate.”

Casino Technology Trends 2025: AI, VR, and Blockchain Impact

Technology isn't just changing how casinos operate; it's redefining what a casino even is. From VR blackjack tables to AI-powered fraud detection, this section dives into the innovations reshaping customer expectations and operational capabilities.

Virtual reality

Sure, VR is still in its early days, but it's not some gimmick anymore. I recently tried a VR roulette session that put me in a digital replica of a Monte Carlo ballroom, complete with a tuxedoed dealer and ambient jazz. It's a wild ride, and once hardware becomes less clunky, expect a lot more players to trade in their mouse for motion sensors.

Barrier: Adoption is still slow due to hardware costs and user friction, but that won't last forever.

Crypto & blockchain

Crypto casinos are everywhere. Why? Players want privacy, speed, and lower fees. Blockchain also guarantees fairness through transparent algorithms.

Red Flag: Lack of regulation remains a hurdle. But platforms that get licensing right will win trust and wallet share.

AI & machine learning

AI is the unsung hero of 2024. It powers:

- Fraud detection

- Personalized promos

- Dynamic odds adjustments

- Responsible gambling alerts

Projection: The global casino management system market is expected to grow at a 15.28% CAGR through 2030, and AI is its backbone.

Casino Regulation and Taxation 2025: Global Challenges

If there's one thing casino operators lose sleep over, it's regulation. The rules shift from one country to the next, and sometimes from one state to another. Taxes, licensing, cybersecurity protocols - the whole game changes depending on your ZIP code. Miss a requirement? You're not just facing fines; you might be out of the market altogether.

Regulatory harmonization: A long game

Australia, Singapore, Canada, and the UK are pushing for global standards on:

- AML protocols

- Licensing frameworks

- Cybersecurity reporting

Reality check

We're still far from true harmony. Expect more bilateral deals than sweeping reform.

Taxation: Feast or famine

Taxes make or break casino economics. Whether it's Germany's jaw-dropping 90% GGR or Malta's operator-friendly 5%, understanding the tax terrain is essential to assessing risk, profitability, and even long-term viability in a region.

- Germany: 90% GGR - ouch.

- France: 83.5% on poker.

- U.S.: 24% federal tax + state layers = compliance chaos.

- Malta: Just 0.5% to 5% - no wonder it's a licensing magnet.

Advice

For operators, tax strategy is as critical as tech. Poor structuring = bleeding profit.

Responsible Gambling 2025: Safer Gaming Initiatives

In 2024, 1.5 million players used safer gambling tools - up 22%. Awareness is rising, thanks in part to campaigns like Safer Gambling Week, which reached 60 million impressions.

Tools gaining traction:

- Deposit & time limits

- AI-triggered session warnings

- GamStop & BetBlocker integrations

Respect Where It's Due: This is one area where regulation is actually helping shape better industry behaviour, and that's a win for everyone.

Economic Impact: More Than Just Jackpot Glitz

Casinos aren't just entertainment hubs; they're job creators, economic engines, and tax powerhouses. This section zooms out to examine the broader impact of gambling on local and global economies, from hiring to procurement to public funding.

In the U.S.:

- $328.65B in total economic activity

- 1.75 million jobs

- $52.71B in public revenues (tax + tribal)

Nevada alone sees:

- $59.6B in economic output

- 330,000 jobs

- Nearly $8B in tax revenue (a third of the state's general fund)

Supply Chain Insight: Casinos are massive local buyers, from security and catering to tech and furniture. Harrah's Cherokee spent $38M locally in 2024. That's the kind of money that supports regional economies.

Casino Operator Takeaways for 2025

Casino Market Forecast & Outlook 2025 - 2030

So, where does the industry go from here? With tech racing ahead, regulations tightening, and new markets opening, it's not a question of whether the casino landscape will change, but how fast. This section brings together forecasts, predictions, and the factors that will shape the next chapter of casino gaming.

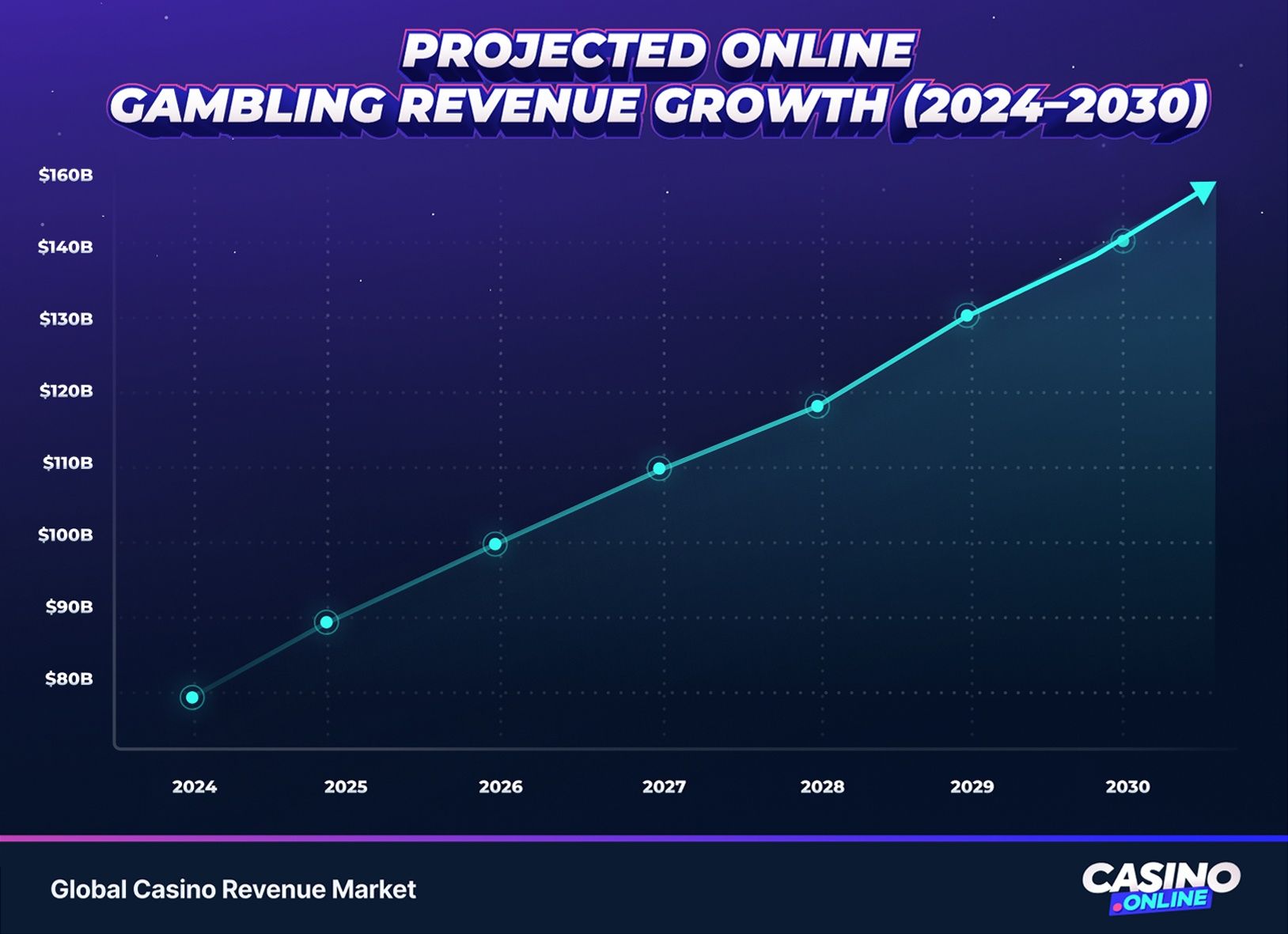

Growth Forecast

The numbers tell a compelling story

- 2025: $273.32B

- 2030: $360.1B

- CAGR: 5.67%

This growth won't be evenly distributed, though. Success will depend on market readiness, digital infrastructure, and regulatory agility.

Digital Acceleration

Mobile-first experiences are now the standard, not the exception. And with 5G rolling out globally, the gap between land-based and online play is shrinking fast. Expect faster games, real-time personalization, and global access.

- Online gambling will hit $153.57B by 2030

- Mobile = 58% of Europe's online gaming revenue

- 5G = faster play + live betting growth

Emerging Markets

Brazil, India, and Nigeria - these aren't the traditional giants of gambling, but they're warming up fast. It's not about a long history of casinos, it's about mobile access, better payment infrastructure, and a whole generation discovering digital gaming. These regions aren't just expanding, they're leapfrogging.

- Africa, Latin America, and Southeast Asia are heating up

- Crypto's helping operators leapfrog traditional barriers

Green Gambling?

Yup. "Carbon-neutral casinos" are no longer a pipe dream. Sustainability is fast becoming a licensing and investor requirement. Whether it's energy-efficient resorts or carbon-neutral platforms, going green isn't just good optics - it's good business. Expect to see:

- Solar-powered resorts

- Waste-reduction goals

- Water conservation tech

- ESG becoming an investor requirement

By 2030, sustainability may be the table stake for licensing.

.jpg)

Casino Industry Risks 2025: What Operators Must Watch

Even with all this momentum, the casino industry isn't bulletproof. In fact, it faces some of the most complex risks of any entertainment vertical - regulatory unpredictability, cyber threats, and economic instability. This section explores what could go wrong and how operators should prepare.

- Regulatory Complexity: Global expansion = compliance minefield.

- Cybersecurity: MGM's ransomware attack was just a taste.

- Economic Volatility: Recessions, wars, crypto crashes, any of these could dry up discretionary income.

- Overreliance on Tech: AI is great until it's not. Over-personalisation can creep players out or miss the mark.

Opinion of Andrew Collins

“Word to the Wise: Tech is a tool, not a crutch. Balance innovation with humanity.”

Casino Industry Outlook 2025: Key Takeaways & Operator Insights

The global casino sector is walking a tightrope, and doing a damn good job of it. It's blending legacy glitz with digital innovation, meeting players wherever they are: casino floors, couches, or crypto wallets.

The next decade will reward brands that go beyond gimmicks:

- Personalise the experience, not the addiction.

- Balance innovation with integrity.

- Think global, act local, and stay agile.

To anyone betting against the house, good luck. But from where I'm sitting, the casino industry just stacked the deck in its favour.

.jpg)

Casino Industry FAQ 2025

What is the total global casino market revenue in 2025?

The global casino market is projected to reach $273.3 billion in 2025, with nearly half of all growth coming from online and mobile channels.

Which regions are driving the fastest casino revenue growth?

Asia-Pacific leads in pace, with Macau, the Philippines, and Vietnam showing rapid rebounds, while the US leads by absolute size, and Europe dominates in online share.

How will online casino revenue change by 2030?

Forecasts predict iGaming revenue will nearly double, hitting $153.57 billion by 2030, thanks to tech, regulation, and a new generation of mobile players.

What regulatory risks should casino operators watch?

Heavy tax regimes (like Germany's 90% GGR), cybersecurity requirements, and compliance with new responsible gaming laws will shape profit and strategy.

How can analytics dashboards improve casino business?

Real-time dashboards allow operators to optimize promotions, monitor player behavior, and spot trends for better revenue performance - critical in a fast-moving sector.

References

Statista. (June 24, 2025). Key information on the global casino and online gambling industry 2024. Statista.

Market Data Forecast. (February 3, 2025). Global Casino Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Land-Based Casino Gaming, Online Casino Gaming), End-User, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033. Market Data Forecast.

American Gaming Association (AGA). (August 21, 2025). Commercial Gaming Revenue Tracker. American Gaming Association' (AGA).

European Gaming and Betting Association (EGBA). (March 24, 2025). European Gambling Market Reaches €123.4 Billion in 2024, With Online Gambling Approaching 40% Market Share. European Gaming and Betting Association (EGBA).

Swasti Dharmadhikari . (July 1, 2025). Asia Pacific Gambling Market Report 2025. Cognitive Market Research.

Ben Blaschke. (January 2, 2025). Macau's gross gaming revenues come in at US$28.3 billion in 2024, up 24% year-on-year. CDC Gaming.

Trading View. (September 11, 2025). MGM Resorts International Reports Fourth Quarter and Record Full Year 2024 Results. Trading View.

Flutter Entertainment. Flutter Entertainment Annual Report 2024. Flutter.

CAESARS ENTERTAINMENT, INC. 20224 Annual Report. Caesars.

Sands. (January 29, 2025). Las Vegas Sands Reports Fourth Quarter 2024 Results. Sands.

Research and Markets. (August 1, 2025). Casino Management Systems Market - Global Forecast 2025-2030. Research and Markets.

Gambling Commission. Industry Statistics - November 2024. Gambling Commission.

Bureau of Labor Statistics. Gambling Services Workers. Bureau of Labor Statistics.

Written by

Andrew Collins

Author

I've spent over nine years at five leading iGaming firms - and long before that, I was emptying slots and balancing takings since 1992. From diving deep into slots and unearthing hidden betting strategies, I deliver witty, actionable advice that even seasoned bettors appreciate. Ready to elevate your play with me and casino.online? Let's get started!

Facts checked by

Jacob Evans

Content Writer & Casino Specialist

I'm Jacob Evans, your go-to expert in online gambling. With a robust background in casino gaming and a knack for breaking down complex betting strategies, I'm here to guide you through online casinos, sharing tips to help novices and seasoned bettors excel.