Global Gambling Regulation Comparison: 2025 Edition

Article by

Updated by Jacob Evans Feb 6, 2026

Global Gambling Regulations have transformed the industry into a complex maze of legal frameworks, compliance hurdles, and bureaucracy that can swallow you whole. After years of navigating everything from EU data quirks to U.S. state laws, I can say this: mastering global gambling regulation is a full-time job. (Sources: 1, 2, 22)

Quick Snapshot: Global Gambling Regulation 2025

Navigating global gambling laws can feel like an uphill struggle. Let's zoom in on the essentials before we dive deeper:

Here's what these numbers mean for operators hoping to play the global game

Market Size and Growth: Riding the Wave

The global gambling market is no small pond - it's a $308.5 billion ocean in 2024, forecast to swell to $328 billion in 2025. Online casino games and other iGaming products now command over 68% of this surge, fueled by mobile play and fresh innovations like VR and crypto payments. If you're not riding this wave, you're sampling from a puddle.

.jpg)

Global Casino Revenue and Market Analysis

AI and Compliance: The New Sheriffs in Town

AI isn't just a fancy tool; it's become the watchdog in the wild west of online gambling. Operators use it to spot fraud, monitor responsible gaming, and keep regulators off their backs. But don't get cute, there's a hard line: push bonuses to vulnerable players, and you'll feel the hammer. Compliance isn't optional anymore; it's your frontline defence.

Many regulators are now grappling with AI‑driven risk tools and marketing engines. For a floor‑level view of how that tech actually works, see our AI and machine learning in casinos from the inside.

Executive Overview: The State of Global Gambling in 2025

The numbers in the snapshot set the stage, but let's cut to the chase: global online gambling is booming like never before. Operators are riding a rocket fueled by mobile play, fresh game innovation, online betting, crypto payments, and AI-powered tools. Yet with opportunity comes a regulatory gauntlet more tangled than a fishing line after a weekend on the river.

Last year alone, operators worldwide coughed up over £67 million in fines. Regulators aren't just giving a ticking off, they're sending a proper wake-up call. From rooting out money laundering to tackling problem gambling and tightening control over data, the compliance noose is definitely getting tighter. Snagging your license is only the first lap of the race; the real test is keeping in step with an ever-changing patchwork of rules across different places.

The best operators? They treat compliance like breathing, effortless and instinctive. It's not a checklist; it's their edge, earning respect and keeping them in front. In this wild game, following the rulebook isn't playing it safe; it's how you stay standing when the dust settles. (Sources: 1, 3, 5, 21)

Online Gambling & iGaming Industry Landscape

Online gambling now grabs over 68% of global iGaming revenue, led by online casino games, poker, and sports betting. Traditional casinos aren't just sitting on the sidelines - they're launching slick platforms that blend trusted brick-and-mortar reputations with anytime, anywhere play of casino games.

As the sector grows, so do the regulatory demands, with each jurisdiction enforcing robust rules for regulated online gaming. Each jurisdiction enforces its own rules, forcing operators to nail robust identity checks, responsible gaming safeguards, and fair play policies to stay compliant and competitive. The UK Gambling Commission sets the gold standard with strict identity verification, AML protocols, and responsible gaming initiatives.

Sports betting operators and online poker have gone from supporting acts to headline players, heating up the legal online gambling scene. But big money means big responsibility. These days, platforms can't just talk a good game about player safety; they've got to jump in boots-first. AI-powered tools that spot problem gambling and pump the brakes on risky play aren't optional extras anymore; they're the heavy hitters keeping the game fair and players protected.

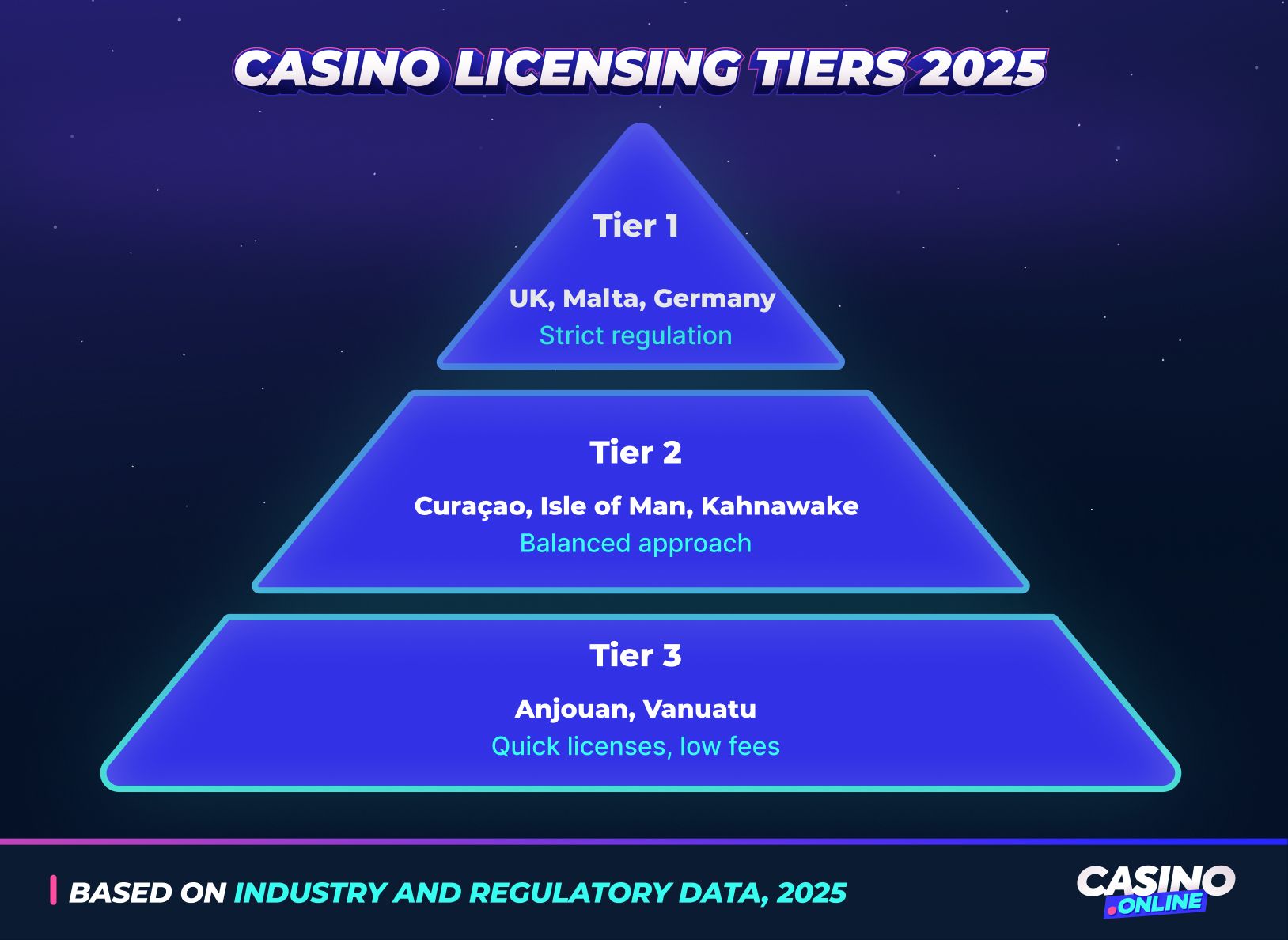

Comparing Online Gambling Regulations: Tiered Licensing Framework for Betting Operators

Picking the right gambling license is key to succeeding in regulated online gaming - too small and you miss out; too flashy and your compliance risks spike. That's why we break the licensing landscape into three tiers. This helps you reel in the right kind of regulatory environment for your operation and avoid costly tangles.

Deep waters or calm shallows, that's the real question. A top-tier license puts regulators on your back like hawks, but it wins respect. A budget-tier one lets you fish with fewer fees, though you might get side-eyed. Pick based on your growth targets, your wallet, and how much cred you need.

Tier 1: Regulatory gold standard

These regulators don't cut corners. The price is high, but your peace of mind is worth it. The UK Gambling Commission (UKGC) leads the pack, enforcing strict consumer protections, affordability checks, marketing restrictions, and a mandatory gambling levy. It's not the cheapest license, but it's among the most respected globally. Operators invest here for long-term trust and access to mature markets.(Sources: 3, 4, 5)

Tier 2: Smart middle ground

Ideal for growing operators or those seeking fair rules without the premium Tier 1 price tag. Curaçao has reformed its act with the new CGA, adding teeth to what was once a rubber-stamp license. The Isle of Man offers a classy and compliant license with higher upfront costs but dependable backing. Kahnawake is often overlooked but offers real value for operators targeting North America's unique market.

- Curaçao: A reformed bad boy. The new CGA adds teeth to what was once a rubber stamp. (Sources: 8)

- Isle of Man: Classy and compliant. Expect higher upfronts but long-term dependability. (Sources: 6)

- Kahnawake: Often overlooked, but offers real value for operators targeting North America. (Sources: 7)

Tier 3: Quick-and-cheap licenses with caveats

These are the flea markets of iGaming regulation, fast entry but with risks. While Anjouan lets you in cheaply and quickly, it's less respected by banks and ad platforms, limiting reach in Western markets. Emerging operators love Vanuatu for its fast-track, low-cost license, but don't expect it to open many doors - banks and players often give it the side-eye. Picking a Tier 3 license is a trade-off: you snag speed and savings, but credibility and growth potential can stall.

- Anjouan: Cheap, fast, and functional, just not ideal for reaching high-value Western players. (Sources: 7)

- Vanuatu: Emerging operators love it, but limited brand recognition holds it back. (Sources: 7)

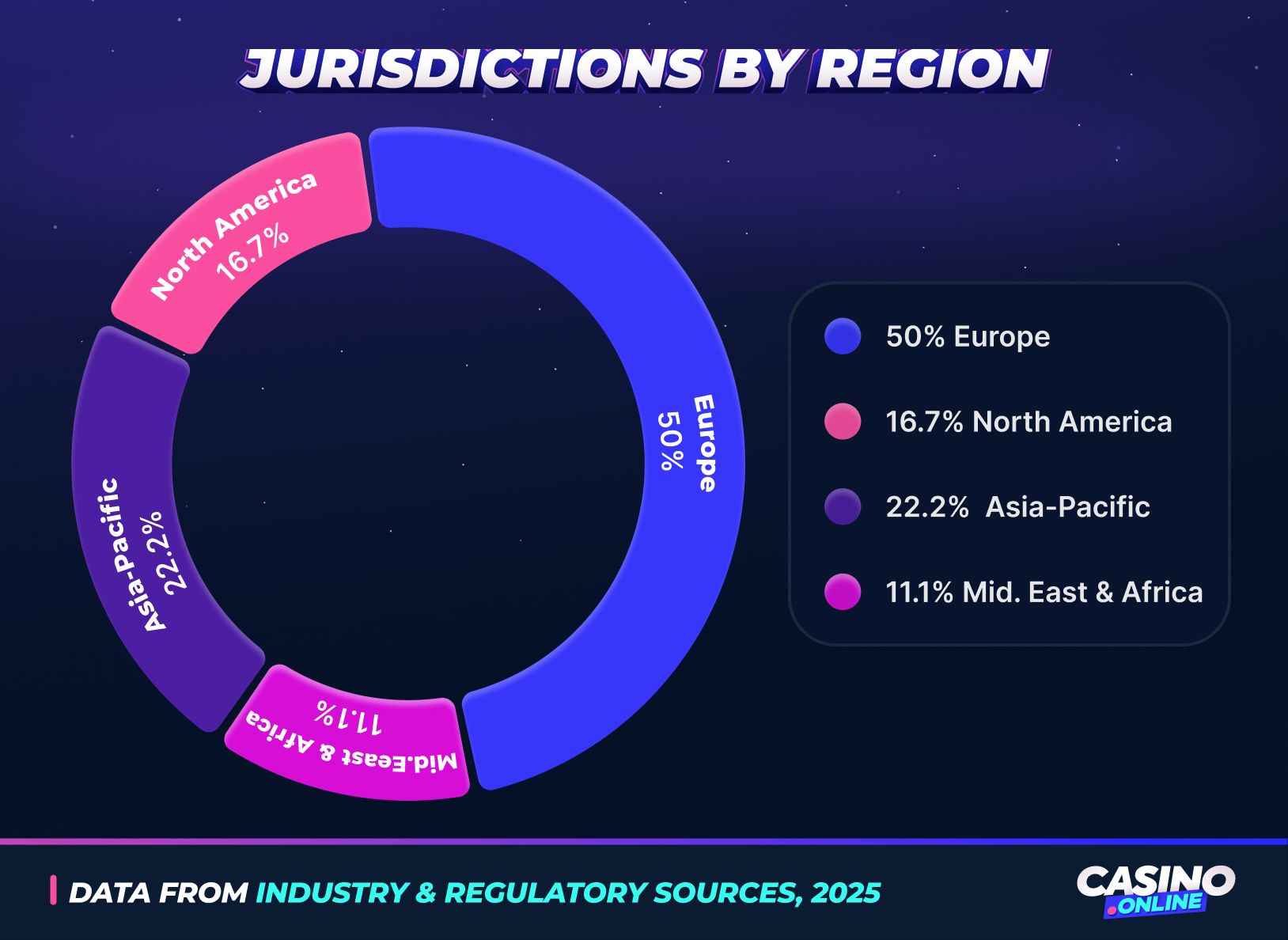

Region-by-Region Breakdown: Gambling Laws, iGaming Regulation & Relevant Authorities Worldwide

Now that we've mapped this licensing terrain, here's the lowdown: Europe and North America are like two different rivers. In some stretches, the current's locked down tighter than a drum, while elsewhere you could paddle right through the gaps.

Europe

Think of Europe as a sprawling patchwork quilt; GDPR and AMLD set the broad pattern, but each member state threads in its own design. Spain demands dual licenses and bans flashy ads. The Netherlands is making strides, but charges a premium for permits. France keeps online casinos on ice; only poker and sports bets get the green light. Each country adds a twist, so operators must stitch regulatory compliance into every market plan. (Sources: 2, 9)

- Spain: Dual licensing, tough advertising rules. (Sources: 10)

- Netherlands: Overall progress, but expensive and ad-heavy. (Sources: 9)

- France: Currently no online casinos licensed - poker and betting only. (Sources: 9)

North America

- Fragmented U.S.: State laws vary, including the *Indian Gaming Regulatory Act for tribes. (Sources: 11, 12)

- Canada: Hybrid physical plus growing online gambling markets. (Sources: 11)

* The Indian Gaming Regulatory Act, originally for land-based tribes, now shapes how tribal authorities approach online gaming partnerships - especially after India's 2025 real-money ban drove tribes into regulated online deals.

Asia-Pacific

Asia's a different beast - online sports betting is exploding, but places like South Korea and Japan keep a tight leash on both digital and bricks-and-mortar casinos.

- Macau: Traditional casinos dominate. (Sources: 13)

- Philippines: Local market steady. Offshore POGO ceased in 2024. (Sources: 13)

- Singapore & Japan: tight controls on online and land-based gambling. (Sources: 13, 14)

- South Korea remains highly selective. Many online bets are outright banned, and tight social-responsibility and anti-corruption measures are central to government policy.

Middle East & Africa

- UAE: Surprisingly progressive. A few mega-resorts in the pipeline. (Sources: 13)

- South Africa: Well-regulated but confusing. Online gambling is still a grey area. (Sources: 13)

Latin America

Latin America's online gambling scene is heating up fast thanks to fresh laws designed to bring online casinos into the regulatory fold and keep players safe. Colombia's Coljuegos sets the standard with a clear, no-nonsense framework that operators respect, while Brazil and Argentina hustle to build transparent regimes that lure legit operators and push out the riffraff.

We've cast our net far and wide; now, let's wade into the hottest trends shaping compliance and strategy in 2025. After all, you can't reel in the big one unless you know exactly which current to ride.

Key Trends Shaping 2025's Online Casino Gambling Regulations and Social Responsibility

Now that we've got the lay of the regulatory land, let's flip the script and shine a torch on what's coming next. From crypto firestorms to AI watchdogs breathing down your neck, these aren't just industry buzzwords; they're the undercurrents sweeping the gambling world downstream in 2025. Spotting them now means you're not just paddling along; you're setting yourself up to ride the next big swell.

Crypto & Web3

Let's be blunt: regulators are split. Some embrace it with AML strings attached (like the UK), others slam the door shut. Crypto's staying, but if you're not tracking its source or volatility, you'll get grilled. (Sources: 19)

AI & compliance

Using AI to flag fraud? Great. Using it to push bonuses to at-risk players? That's a hard no. Expect more scrutiny and stronger human-in-the-loop requirements. (Sources: 17, 20)

Responsible gambling

The honeymoon's over: deposit limits, affordability checks, and stiff fines are mandatory now; no more polite suggestions. They've turned responsible gambling into a legal must; no more polite suggestions. Now it's deposit caps, reality checks on player budgets, pop-up warnings, and real teeth in the form of hefty fines if you slip up. Betting operators must embed protections like self-exclusion tools and transparent marketing to comply and protect players; the law leaves no room for shortcuts. (Sources: 4, 18)

ESG Standards

Your carbon footprint and social responsibility efforts could be the deciding factor in new license bids. The "casino-as-a-good-citizen" trend is gaining real traction. (Sources: 22, 23)

Live streaming and social gaming features are reshaping how online casino games engage players. Up next, we'll tackle the real-world hurdles operators face when it comes to market access - think banking blocks, payment puzzles, and regulatory roadblocks that can snare even the savviest players. Stick around; this is where theory meets the gritty day-to-day grind.

Market Access Implications: Banking, Payments & Cross-Border Barriers

Getting licensed is just the first hurdle. The real challenge? Actually accessing markets once you've got that shiny license in hand.

Banking restrictions tighten the noose

Banks worldwide are making life harder for gambling operators. Major UK banks like HSBC, Barclays, and Monzo now offer voluntary gambling transaction blocks, while similar restrictions spread across Europe and Australia. These aren't just consumer protection tools, they're market access barriers that can choke off revenue streams overnight.

Credit card restrictions bite hardest. Since April 2020, UK operators haven't been able to accept credit cards at all, forcing a shift to debit cards and alternative payments. But here's the kicker: these restrictions apply to international transactions too, meaning UK-issued cards won't work on overseas gambling sites.

Cross-Border payment nightmares

Cross-border payments? That's a real headache, one minute you're juggling currency conversion fees, the next you're watching players fume over exchange rate surprises and slow payment processing. Brazilian players paying in BRL face surprise charges when sites process in USD, leading to transaction abandonment.

Payment method fragmentation makes things worse. North Americans expect cards and PayPal, Latin Americans want Pix and Boleto, while Southeast Asians prefer GrabPay and ShopeePay. Miss their preferred method, and you lose conversions.

Regulatory compliance creates market walls

Each jurisdiction's KYC/AML requirements create de facto barriers to entry. Brazil's new financial oversight rules require institutions to monitor and block transactions with unlicensed operators, effectively wall off the market from unauthorized players.

The EU's fragmented approach means operators need 145+ licenses across 17 countries just to operate legally across Europe. Malta's protective MGA framework faces EU legal challenge, potentially exposing operators to cross-jurisdictional claims.

The bottom line

Market access goes way beyond just ticking compliance boxes - you're threading through a maze of banking roadblocks, payment headaches, and regulatory brick walls that can slam shut even when you've got all the right paperwork. The savvy operators? They're already planning for these hurdles before they even think about entering a new market.

(Section: 24, 25, 26, 27, 28, 28, 29, 30, 31)

Practical Advice for Betting Operators: Navigating Online Gambling Regulations with Social Responsibility

Don't just shop the bargain basement for licenses. Choose spots that fit your growth plans, product lineup, and player base. Lean on smart tech to lock down KYC and AML. And make compliance part of your morning coffee routine, not something you bolt on at the last minute.

Pick markets that match your strategy

Pick Markets That Match Your Strategy

Double down on tech

Your KYC, AML, and geolocation systems must be airtight. (Sources: 12, 16)

Audit proactively

Regular internal compliance checks help you avoid surprises.

Make compliance part of your company culture

If your teams dread regulatory updates, it's a red flag.

Think long-term

Partner with regulators and licensing bodies that evolve alongside the industry, because rules will continue to change.

Opinion of Andrew Collins

“Don't chase the cheapest ticket - pick a license that actually opens doors and lets you grow without strangling your compliance team.”

2025-2026 Regulatory Pipeline: What's Coming Next

The regulatory calendar is packed. New Zealand plans to issue 15 online casino licenses by February 2026, while Brazil develops its B2B supplier certification system after gaps were exposed by uncertified live casino equipment. Other regulatory changes to note:

- Armenia implements phased tax increases, online casino fees quadrupling from $890K to $3.5M by 2028.

- Paraguay breaks its licensing monopoly, allowing up to three operators per game category.

- Cross-border cooperation intensifies, with Switzerland-Liechtenstein's shared exclusion lists potentially becoming the European model (22, 25).

Meanwhile, EU regulatory harmonization discussions continue, though national sovereignty remains a major obstacle (23).

Final Thoughts: Compliance as a Competitive Edge

Thinking of compliance as a headache leaves you on the back foot. Make it your playbook instead, and you'll catch opportunities others walk right past. This guide? Your roadmap through gambling regs chaos, whether you're testing waters or cannonballing in.

Success isn't down to chance; it's locking in smart licenses, keeping compliance tight, and staying ahead. The sharp operators don't tick boxes - they collect compliance wins like trophies, backing them with straight talk, bulletproof KYC, and kit that keeps players protected and coming back.

FAQ - Global Gambling Regulations

What are the strictest gambling regulators in 2025?

If you want to play in the big leagues, look to the UK, Germany, and Malta. These regulators don't mess around - they've got tough rules to protect players and keep operators honest. Want the nitty-gritty? Check out the "Comparing Regulation" section above.

Which gambling licenses are cheapest to obtain?

Tier 3 spots like Anjouan or Vanuatu serve up wallet-friendly, express-lane licenses, but don't let the low price fool you. They carry a credibility hangover that can lock you out of prime banking deals, ad channels, and big-spender markets. Savvy operators use them as practice reels, not the main catch.

Who governs online gambling worldwide?

There's no global sheriff in this town. Instead, national bodies - think the UK Gambling Commission, Malta's MGA, and Curaçao's CGA - call the shots in their own backyards. Regulators are starting to team up, but the pace is more leisurely than the industry's breakneck speed, leaving operators to weave their way through a patchwork of rules.

How do gambling laws compare across different continents?

Gambling laws are all over the map: in Europe you juggle EU directives and country-by-country rules, in the US it's a patchwork quilt of state statutes, and in Asia-Pacific you'll find everything from long-standing land casinos to freshly minted online markets. Each region plays by its own rulebook.

Are crypto casinos legal in 2025?

Some regulators cautiously embrace crypto with stringent AML and source-of-funds checks, notably the UK and Malta. Others ban it outright or remain on the fence, making crypto compliance a high-stakes game. Operators must be ready to pivot fast as rules continue to evolve. For more on this and other hot trends, see the "Key Trends" section.

What social responsibility demands do operators face?

Today's betting operators need to do a lot more than just tick boxes. They have to actively watch over their players - setting deposit limits, keeping an eye out for risky behavior in real time, and following strict advertising rules. Regulators aren't taking it lightly anymore; social responsibility is baked right into licensing, so falling short isn't an option.

What market access hurdles are biggest in 2025?

Banking restrictions and transaction blocks from major banks are now key choke points. Cross-border payment fragmentation means missing a region's preferred payment method can tank conversions. Plus, meeting dozens of local KYC/AML regimes is costly and operationally complex, demanding long-term planning.

What major regulatory changes are confirmed for 2025-2026?

New Zealand is issuing 15 online casino licenses by February 2026, Brazil is developing B2B supplier certification after equipment compliance issues, and Armenia is quadrupling licensing fees by 2028. Paraguay is ending its licensing monopoly, allowing three operators per game category. Cross-border cooperation is expanding; Switzerland and Liechtenstein now share exclusion lists, potentially becoming the European standard.

How is the online gambling industry evolving in 2025?

The online gambling industry in 2025? It's like watching a champion darts player - mobile-first precision, AI that knows your next move, and crypto flowing like pints after a win. Players want games that test their mettle with mates cheering them on, while regulators keep tightening the screws on responsible play and privacy. Hit the treble twenty on these trends or find yourself nursing a pint on the sidelines.

How is the shift from land-based casinos to online betting changing the industry?

Traditional casinos aren't just hanging back, they're diving headfirst into online betting with their own platforms. The best juggle their trusted brick-and-mortar names with slick online experiences players can count on anytime, anywhere. It's about making the shift seamless and trustworthy.

References

International Comparative Legal Guides. (November 19, 2025). (1) Gambling Laws and regulations 2025. International Comparative Legal Guides (ICLG).

Elizabeth Sramek. (August 7, 2025). (2) iGaming Regulations Across the EU - A Complete Guide in 2025. Scaleo.

Alex Walker. (June 17, 2025). (3) UK Gambling Regulations in 2025: the UK Government 'doubles-down' on consumer protection. Clifford Chance.

Gambling Commission. (4) New rules boosting safety and consumer choice. Gambling Commission.

Roman Baranovskyi. (May 5, 2025). (5) Scanning on changes in Gambling Regulation in the UK for upcoming months: What's next?. Finextra.

Turbomates. (June 14, 2024). (6) 2025 iGaming Licenses Comparison of Popular Jurisdictions. Turbomates.

Legal Pilot. (7) Gambling License, Registration & Certification Costs. Legal Pilot.

Van Holland Group in Curaçao. (February 15, 2025). (8) Understanding Curacao's Online Casino Licensing. Van Holland Curaçao.

Ian Macintyre. (September 10, 2024). (9) Gambling Laws and Regulations in Europe in 2025. Altenar.

Staff Reporter. (February 24, 2025). (10) Online Gambling in Spain in 2025: Latest Regulations Updates for the Local Market. The Olive Press.

Sports Betting Soft. (11) How to Get a Sports Betting License in the USA: A State-by-State Guide (2025). Sports Betting Soft.

Alessa. (December 28, 2022). (12) Simplifying Casino Compliance: Automation and Integrated Systems. Alessa.

Gambling Insider. (13) Asia focus 2025. Gambling Insider.

Editorial Team. (February 12, 2025). (14) Casino AML Compliance: The 2025 Ultimate Guide. Sanctions.io.

Financial Crime Academy (FCA). (July 18, 2025). (15) Understanding AML Regulations for Casinos. Financial Crime Academy.

Allsa Abramova. (May 19, 2025). (16) KYC for Gambling: What It Is and Why It's Crucial (2025 Guide). The Sumsuber.

Edoardo D'Angelo. (March 25, 2025). (17) The Role of AI and Machine Learning in Online Gambling Compliance. LinkedIn.

Betting & Gaming Council (BGC). (18) The BGC Responsible Gambling Code. Betting & Gaming Council (BGC).

Coincub. (19) What Are the Latest Laws on Gambling with Crypto Around the World?. Coincub.

Giulio Coraggio. (April 13, 2025). (20) Legal Obligations for Online Gambling Operators in the Use of Artificial Intelligence (AI). DLA Piper .

Gambling Insider. (March 17, 2025). (21) Regulating the Game 2025 Sydney: A defining success in gambling regulation and industry innovation. Gambling Insider.

Nux Game. (February 10, 2025). (22) How Much Does It Cost To Get an Online Gambling License in 2025?. Nux Game.

Gambling Commission. (23) Block gambling payments with your bank. Gambling Commission.

HSBC UK. (24) Frequently asked questions on credit card restrictions. HSBC UK.

Robert Prendergast. (November 11, 2024). (25) Protecting banking customers using gambling restrictions. Retail Banker International.

Offshore Getaways. (26) Managing Cross-Border Payment Challenges in International Casinos. Offshore Getaways.

Tom Mendelson. (May 14, 2025). (27) Cross-Border Payments in Gaming: New Solutions for Payments. Rapyd.

PhotonPay. (April 16, 2025). (28) 6 Cross-Border Payment Challenges in Gaming - and How to Solve Them. PhotonPay.

Softswiss. (June 30, 2025). (29) iGaming Trends 2025: First Half-Year Recap. Softswiss.

EGBA. (30) A truly European sector. EGBA.

Denitsa Lyutskanova. (August 1, 2025). (31) EU iGaming in 2025: Limits, Levies & Legal Loopholes Explained. iGaming.

Written by

Andrew Collins

Author

I've spent over nine years at five leading iGaming firms - and long before that, I was emptying slots and balancing takings since 1992. From diving deep into slots and unearthing hidden betting strategies, I deliver witty, actionable advice that even seasoned bettors appreciate. Ready to elevate your play with me and casino.online? Let's get started!

Facts checked by

Jacob Evans

Content Writer & Casino Specialist

I'm Jacob Evans, your go-to expert in online gambling. With a robust background in casino gaming and a knack for breaking down complex betting strategies, I'm here to guide you through online casinos, sharing tips to help novices and seasoned bettors excel.